This post comes from Budgets Are Sexy guest columnist Mr. 1500. He hit financial freedom at the age of 43 with $1,800,000, and is the founder of a financial blog, 1500Days.com.

Life is good in retirement. I’m thrilled to have a net worth of $1,900,000 which enables me to live my life on my own terms. Instead of answering to Mr. Bossman, I wake up and do whatever I want.

On some days, I’ll ride 40 miles into the mountains. On others, I’ll spend hours at the library. Money is a wonderful facilitator. Sometimes, the money even enables questionable purchases like fancy cars and human kites. But I digress…

If I could give you one piece of advice, it would be this: Never stop learning.

Once you become stuck in your ways, you become an intellectual deadbeat. Don’t do it.

I have enough money so that I no longer have to pay attention to it, but I’ll never stop learning. I discover things about money every week that surprise me and make me a better saver/investor.

Today, I’ll share some of my favorite money hacks with you. I’ll also be sharing questionable underwear choices. Don’t worry, it will all make sense. (Or worry, because there are pictures!)

1. Writing every transaction down

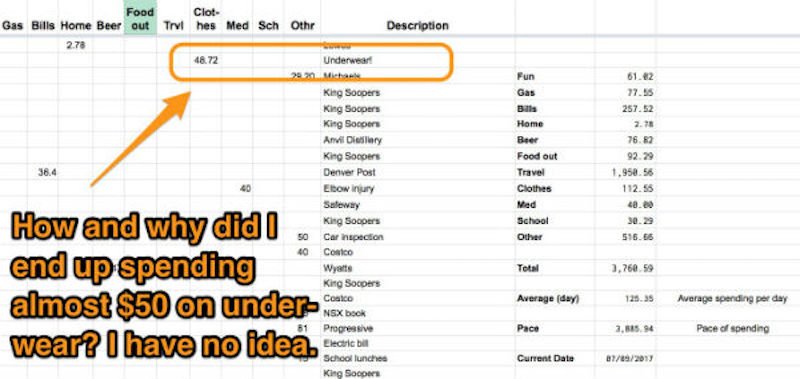

Until recently, I never kept track of my spending. A couple of years ago, I started recording every dollar that went in and out. To state that I was shocked by my spending is an understatement.

Having to answer to a spreadsheet is a powerful behavioral changer. I suggest at least partially automating the tracking which brings me to my next tip:

2. Using a spreadsheet to track your spending

I created a spreadsheet on Google Drive which adds up my spending as I go. Here is my real spreadsheet from April where I blew a load of money on underwear and travel:

If you don’t like the hassle of a manual spreadsheet, you can also use software like Mint or Personal Capital to track your dollars.

3. Loving credit cards

I wade into dangerous territory here. Credit cards are like nukes. Use them responsibly and they do wonderful things. Use them carelessly and:

BOOM!

People ask me questions like this all of the time: How much should I sacrifice when I’m saving for financial independence? Should I skip vacations?

You don’t have to sacrifice anything. Here is proof:

I took that picture on the Eastern Coast of Kauai where I traveled with my family of four. We woke up every morning at dawn to watch the sunrise and frolic in the surf. We’d hike and snorkel in the afternoon. At night, we ate dinner on our patio, listening to the waves roll in.

In case I’m not painting the picture correctly — It was one of the best weeks of our lives!

And the best part? All four airline tickets set us back less than $200. We were able to do this using credit card points.

Now, travel hacking is a voluminous subject. If you’re not learned in the ways of travel hacking, check out the Travel Miles 101 course (free and great!) or J’s one-on-one interview with Brad. And if you need a card, you may want to check out Mad Fientist’s credit card tool.

But wait! Before you even consider any of this, you must raise your right hand and repeat after me: I will use credit cards responsibly! I will never, ever carry a balance!

Don’t let credit cards nuke your finances. Do let them take you to Hawaii.

4. Never thinking of purchases in terms of *present* value

Nothing drives me crazier than when I hear someone say this: My new car is only $25,000.

It isn’t $25,000. Money invested in the markets typically takes less than 10 years to double. Unless you’re close to death, big ticket purchases can set you back hundreds of thousands over the long term. Think long term to fully appreciate the impact of all purchases.

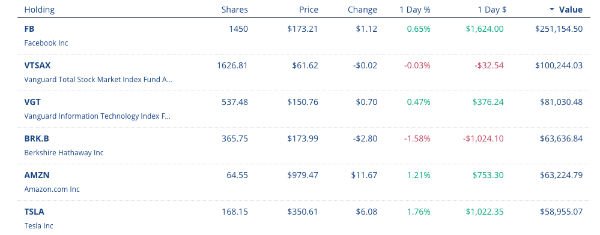

5. Using Personal Capital

Life is complicated, and so are your finances. Between my 401(k), savings, checking and investments accounts, I have my money in about 3,384 different places. At least it feels that way.

This problem is easily remedied with a Personal Capital account. Personal Capital aggregates all of your accounts into one place. Here is a screen capture from my own Personal Capital dashboard (it’s OK to look, no underwear pics this time):

Best of all, Personal Capital is free. Who doesn’t like free?

6. Studying computers

This one actually came from my grandmother three decades ago. She knew computers were going to be a «thing» and would say this to me every time I saw her: Study computers!

My grandmother was crazy in a lot of ways, but this was some of the best advice I ever received. There are loads of unfilled computer jobs. And you don’t have to go back to college for a degree. There are boot-camps all over the United States where you can spend under a year studying and come out with a good job. Many will even refund your money if you can’t get a job.

I did this myself – dropping out of pharmacy school to attend an accelerated program. 30 weeks later, I had a great job and never looked back.

And if you’re still unsure about why you should study computers, consider how many folks in the financial independence community had jobs in high tech. Mr. Money Mustache, Mad Fientist, Go Curry Cracker!, ThinkSaveRetire …

Read the original article on Budgets Are Sexy. Copyright 2017.